S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

4 Apr, 2022

|

| HDFC Bank's merger with its parent company will give it greater scale and the ability to accelerate growth. Source: HDFC Bank |

The proposed merger of India's leading mortgage lender with the nation's biggest private-sector bank will create a financial services powerhouse with economies of scale and the ability to raise funds at competitive rates.

HDFC Bank Ltd. said April 4 that it will merge with its parent, Housing Development Finance Corp. Ltd., to grow its home loans portfolio as housing demand is poised to drive the Indian economy. The combination will also help the bank reduce the proportion of its unsecured loans and the expanded balance sheet will allow it to underwrite larger ticket loans, according to a company announcement.

"As the son grows older, he acquires his father's business," HDFC Chairman Deepak Parekh said after the announcement.

Opportunities for growth

The merger will increase the bank's product offering and ability to cross-sell to HDFC's customer base, said Darpin Shah, a banking analyst with Haitong International, a securities firm. "The higher share of mortgages would also mean having sticky customers, not only on the asset side, but on the liability side as well," Shah said.

The mortgage segment makes just 11% of HDFC Bank's loan book, with an even smaller share in the high-growth rural and semi-urban areas.

India's housing sales registered a 7% year-over-year growth in the first three months of 2022, according to real estate consultancy firm PropTiger.com. The increase in activity is fueled by record-low home loan interest rates and government-sponsored subsidy programs. In the same period, supply surged by 50% year over year as the economy continues to recover from the drag of the COVID-19 pandemic.

HDFC Bank's rivals State Bank of India, ICICI Bank Ltd. and Axis Bank Ltd. have a bigger chunk of their loan books dedicated to mortgages, according to Sumeet Singh, head of research at Aequitas Research, who writes on research platform Smartkarma.

The combined entity's earnings could improve over the next three to five years, S&P Global Ratings said in a note April 4. The merger will provide the bank with profitable cross-selling opportunities to HDFC's large pool of customers, "especially for high-yield products such as unsecured loans. It would also generate more fee income from insurance and investment products," Ratings said.

HDFC Bank's loans will rise 42% to 18 trillion rupees, or about US$237 billion, Ratings said. The bank will remain the second-biggest lender in India after government-run State Bank of India, though its size will become twice that of ICICI Bank, the third biggest. HDFC Bank's market share in loans will rise to 15% after the merger, from 11% at present.

The merger is expected to complete within 18 months.

Size matters

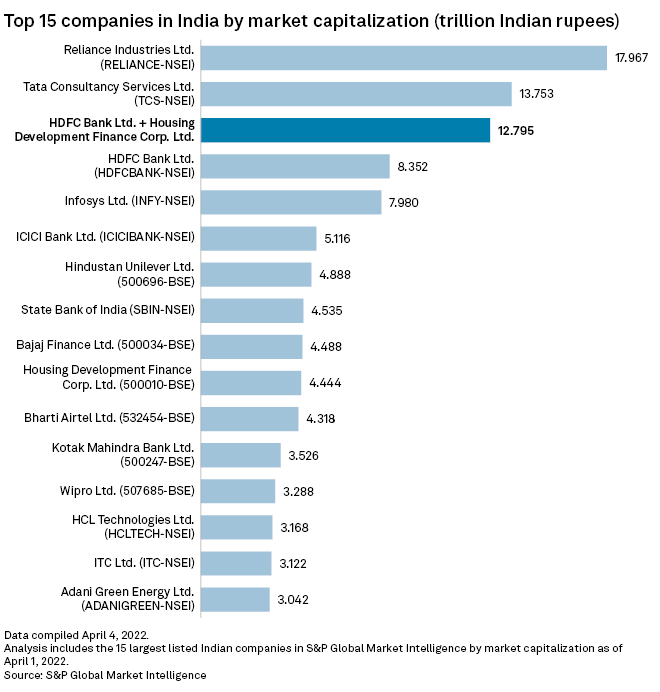

Currently, HDFC and HDFC Bank have a combined market capitalization of about 12.8 trillion rupees, making it the third-largest entity in India, according to S&P Global Market Intelligence.

The merger could attract greater international investments into India's financial sector. Foreign shareholding in the combined entity will be at 65%-67%, leaving a 7% gap to the limit of 74% of foreign ownership in India's banks, HDFC Bank's management team said on an April 4 call with analysts.

"The [foreign institutional investor, or FII] 74% limit became an albatross around the neck from a market positioning perspective," said Amit Kumar Gupta, a portfolio manager with Adroit Financial Services, an Indian securities firm. "Most FIIs couldn't buy more due to the limit and whenever they had to reduce allocation to India ... they sold HDFC bank aggressively."

The additional 7% float that will likely become available will be lapped up by funds, portfolio management services and retail investors, Gupta said.

The merger may also trigger a trend as the central bank has urged larger nonbanking financial companies to convert into banks and tightened rules for the shadow banking sector, Gupta said.

The Reserve Bank of India has been narrowing the regulatory gap between commercial banks and NBFCs as part of its efforts to prevent a repeat of the nation's shadow banking crisis in 2018 when a string of shadow banks failed, triggering systemic risks for all lenders in the economy.

As of April 4, US$1 was equivalent to 75.42 Indian rupees.